Formulary Tiers Explained: How Your Insurance Decides What Drugs Cost

When you pick up a prescription, the price you pay isn’t just set by the drug company—it’s decided by your insurance plan’s formulary tiers, a system that groups medications into levels based on cost and coverage. Also known as drug tiers, it’s how insurers control spending and steer you toward cheaper options—whether you realize it or not. If you’ve ever been shocked by a $200 copay for a drug you thought was covered, you’ve run into a high-tier medication. Most plans have 3 to 5 tiers, and where your drug lands can mean hundreds of dollars in extra cost each month.

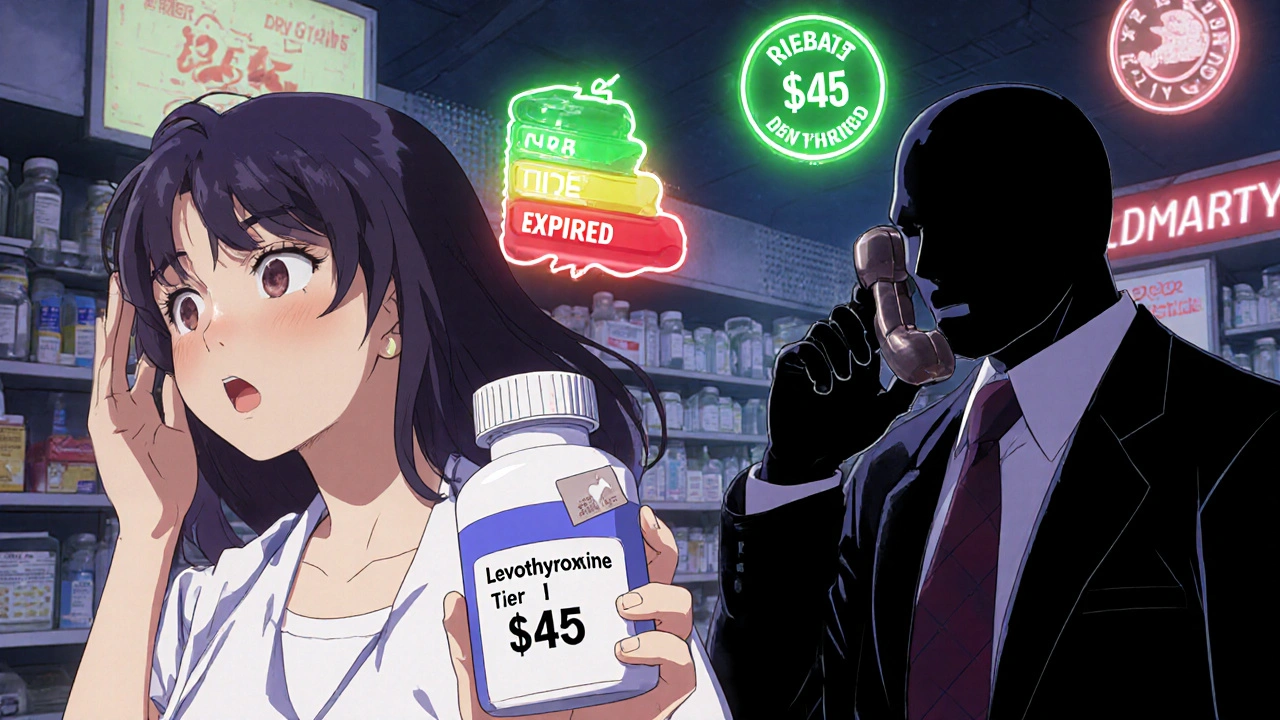

Formulary tiers, a system that groups medications into levels based on cost and coverage. Also known as drug tiers, it’s how insurers control spending and steer you toward cheaper options—whether you realize it or not. Most plans put generic drugs on Tier 1, with the lowest copay—sometimes as low as $5. Brand-name drugs without generics usually land on Tier 2 or 3, costing $40 to $100. Then there’s Tier 4, where specialty drugs live: things like cancer treatments, rheumatoid arthritis meds, or new diabetes pills. These can cost $200 to $1,000 a month, even with insurance. And if your drug isn’t on the list at all? You’re paying full price. The pharmacy benefit manager, a middleman that negotiates drug prices for insurers. Also known as PBM, it’s the hidden player that decides which drugs make it onto each tier and which ones get bumped out. These companies don’t just pick drugs randomly—they get paid by drugmakers to favor certain brands, which is why a cheaper generic might be pushed aside for a pricier one.

It’s not just about cost. Prior authorization, a requirement that your doctor prove a drug is medically necessary before coverage kicks in. Also known as PA, it’s often used for Tier 3 and 4 drugs to limit use. You might need your doctor to fill out paperwork, call the insurer, or even try cheaper drugs first—called step therapy. That’s why some people wait weeks to get their meds, even when they’re prescribed. And if your plan changes its formulary mid-year? Your drug could suddenly jump to a higher tier, or get dropped entirely, with no warning.

But you’re not powerless. You can ask your pharmacist for the tier of your drug. You can check your plan’s formulary list online—most insurers publish them. You can ask your doctor for alternatives on lower tiers. And if a drug you need is too expensive, you can file an appeal. Many people don’t know this, but insurers approve 70% of appeals when you push back with medical evidence.

Below, you’ll find real stories and breakdowns of how formulary tiers affect people every day—from the man who couldn’t afford his COPD drug because it was on Tier 4, to the woman who switched her antidepressant after her insurer dropped the brand name. You’ll see how generic drug quality, drug interactions, and even storage rules can all tie back to what tier your medicine sits on. This isn’t just paperwork. It’s about your health, your wallet, and your right to get the treatment you need.