Generic Drug Copay: What You Really Pay and How to Save

When you pick up a generic drug copay, the fixed amount you pay at the pharmacy for a generic medication covered by insurance. Also known as prescription copayment, it’s often the only part of your drug cost you see—until you realize it keeps going up. Many assume generics are cheap because they’re identical to brand names, but that’s not the whole story. Your copay isn’t just about the pill—it’s shaped by your insurance plan, pharmacy network, and how drug manufacturers price their products behind the scenes.

Not all generic drugs, medications with the same active ingredient as brand-name versions but sold at lower prices. Also known as off-patent drugs, they are required by the FDA to work the same way are treated the same by insurers. Some plans put certain generics in higher cost tiers, making your copay jump from $5 to $30—even if the pill is identical to one you got last month. This happens because pharmacies and insurers strike deals that favor certain manufacturers. A generic version made in India might cost your plan $0.10 per pill, but if your insurer has a contract with a U.S.-based distributor, you could end up paying more. And if your pharmacy is in a narrow network? That copay could double overnight.

The pharmacy copay, the fixed amount a patient pays for a prescribed medication at the point of sale, determined by their insurance plan doesn’t reflect the true cost of the drug. It’s a middleman number—designed to control your spending, not the drug’s value. That’s why two people on the same plan can pay different amounts for the same generic. One uses a mail-order pharmacy with a $10 copay; the other walks into a local store and pays $25. It’s not about the pill—it’s about where you buy it.

And here’s the thing: your medication affordability, the ability to consistently pay for prescribed drugs without financial hardship isn’t just about income. It’s about knowing where to look. Some plans let you switch to a different generic version with a lower copay. Others let you request a tier exception if the drug is essential. And sometimes, paying cash—yes, cash—costs less than your copay. A study by the Kaiser Family Foundation found that for certain generics, the cash price at Walmart or Costco was under $4, while the copay was $15 or more.

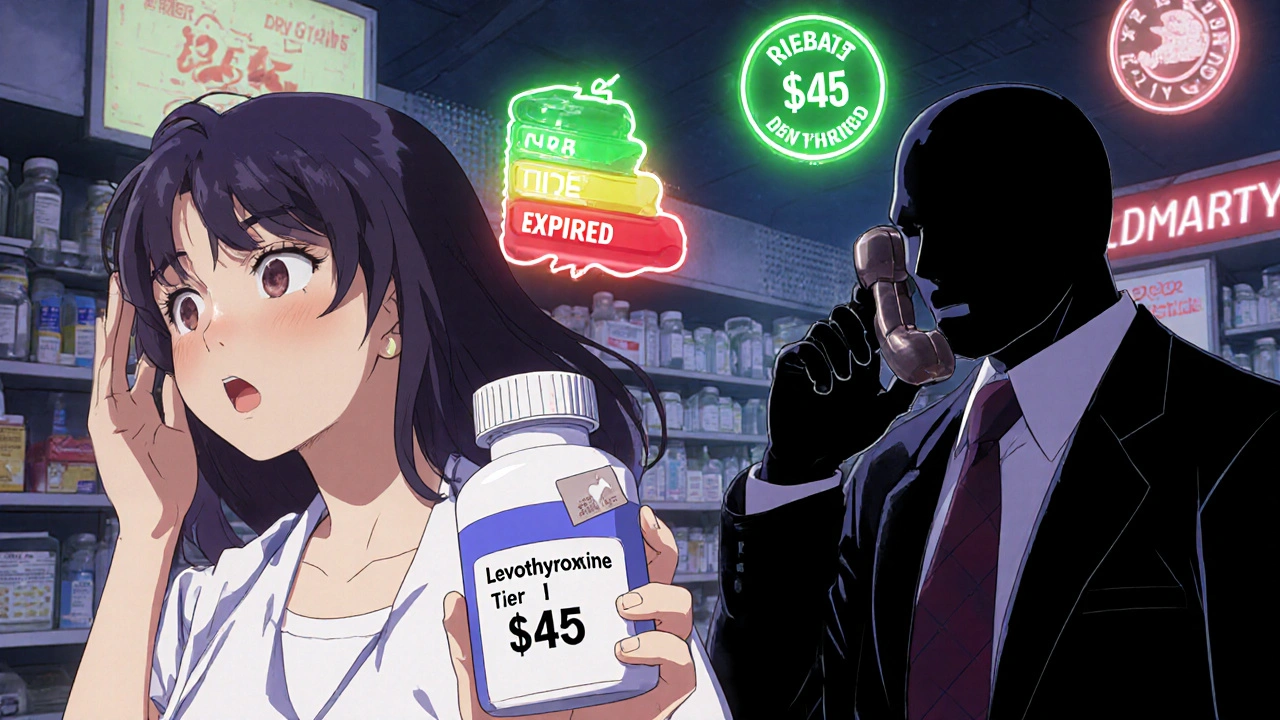

That’s why the real question isn’t just "Why is my copay so high?"—it’s "What can I do about it?" You can ask your pharmacist if a different generic version is available. You can check GoodRx or similar tools before you pay. You can call your insurer and ask for a formulary exception. You can even ask your doctor if a therapeutic alternative exists that’s on a lower tier. These aren’t tricks. They’re standard moves people use to save hundreds a year.

Below, you’ll find real stories and breakdowns from people who’ve navigated this system—how one man saved $400 a year by switching his generic blood pressure pill, why a thyroid medication’s copay jumped after a manufacturer changed hands, and how a simple phone call to your pharmacy can reveal hidden discounts. You’ll also learn why some generics are safer than others over the long term, and how supply chain issues can suddenly make your copay disappear—or skyrocket. This isn’t theory. It’s what’s happening right now, in pharmacies across the country. Let’s get you the facts you need to pay less and stay healthy.