Pharmacy Benefit Managers: How They Control Your Drug Costs and Access

When you pick up a prescription, you might think the price comes from the pharmacy or the drugmaker. But the real power often lies with pharmacy benefit managers, third-party companies that manage prescription drug programs for health insurers, employers, and government plans. Also known as PBMs, they act as middlemen between drug makers, pharmacies, and your insurance plan. They decide which drugs are covered, how much you pay out-of-pocket, and which pharmacies you can use. And while they promise to lower costs, many people find their prescriptions more expensive and harder to get because of how PBMs operate.

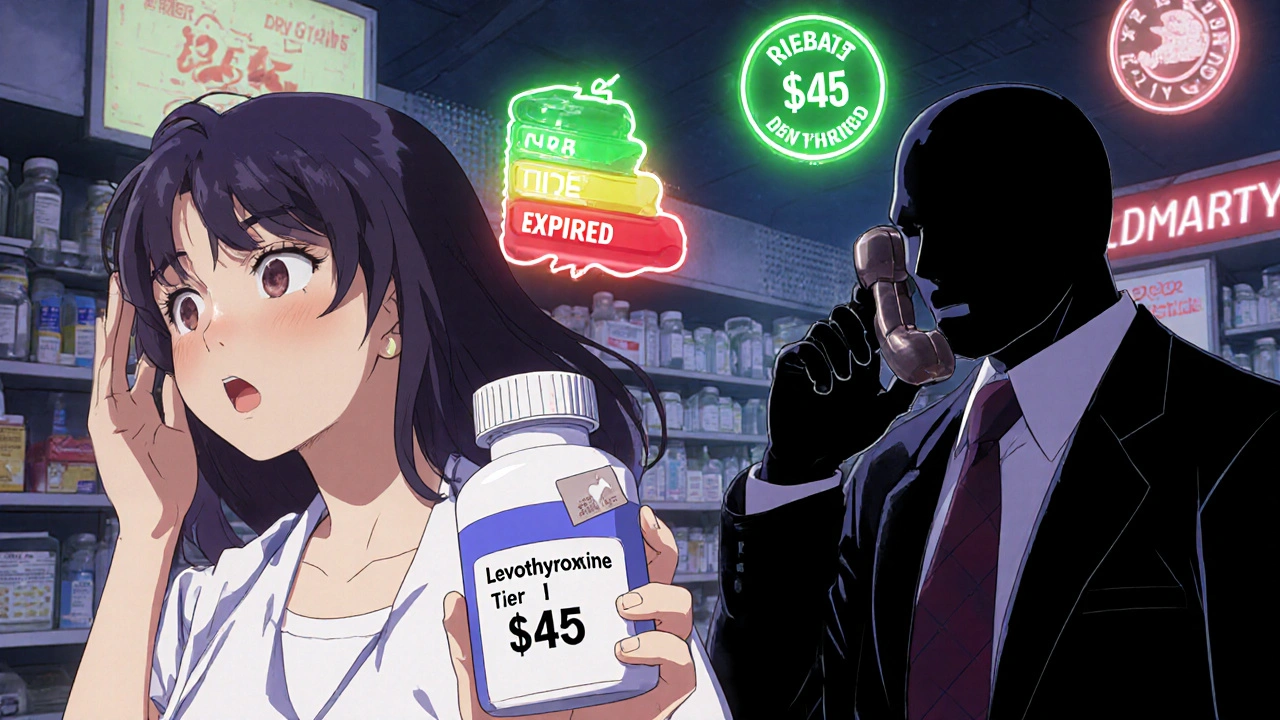

Drug pricing, the final cost of a medication after rebates, discounts, and fees are applied is one of the biggest mysteries in healthcare. PBMs negotiate rebates with drug companies, but those savings don’t always reach you. Instead, they often keep part of the rebate or use it to favor certain drugs over others—even if those aren’t the best choice for your health. That’s why two people with the same condition might pay wildly different prices for the same pill. And if your pharmacy is out-of-network, you could be stuck paying full price even if the drug is technically covered.

Medication access, how easily you can get the drugs you need without delays or denials is another area where PBMs have heavy control. They create formularies—lists of approved drugs—and often require prior authorization, step therapy, or quantity limits. You might need to try three cheaper drugs before they’ll cover the one your doctor prescribed. Or your insurance might only cover a 30-day supply when you need 90. These rules aren’t always based on medical need—they’re designed to save money for the plan, not you.

And it’s not just about cost and access. PBMs also own or partner with pharmacies, creating conflicts of interest. They might push you toward their own mail-order pharmacy even if your local pharmacy has the same drug at a lower price. Or they might charge your local pharmacy a fee just to fill your prescription, making it harder for small pharmacies to survive.

What you’ll find in this collection are real stories and clear breakdowns of how PBMs affect everyday people. You’ll learn why generic drugs sometimes cost more than brand names, how insurance formularies hide the real price of your meds, and what steps you can take to fight back when a PBM blocks your treatment. These aren’t abstract policies—they’re the reason you’re skipping doses, switching pills, or paying hundreds extra each month.