Tiered Copays: How Your Insurance Plan Shapes What You Pay for Medications

When you pick up a prescription, the amount you pay at the pharmacy isn’t random—it’s controlled by your insurance’s tiered copays, a system that groups drugs into levels based on cost and preference, determining how much you pay out of pocket. This structure is built into most Medicare Part D and private health plans to guide you toward cheaper, equally effective options. Think of it like a pricing ladder: the lower the tier, the less you pay. Tier 1 usually covers generic drugs, Tier 2 includes preferred brand-name pills, and Tier 3 or 4 holds expensive non-preferred brands or specialty meds. The higher the tier, the steeper your copay.

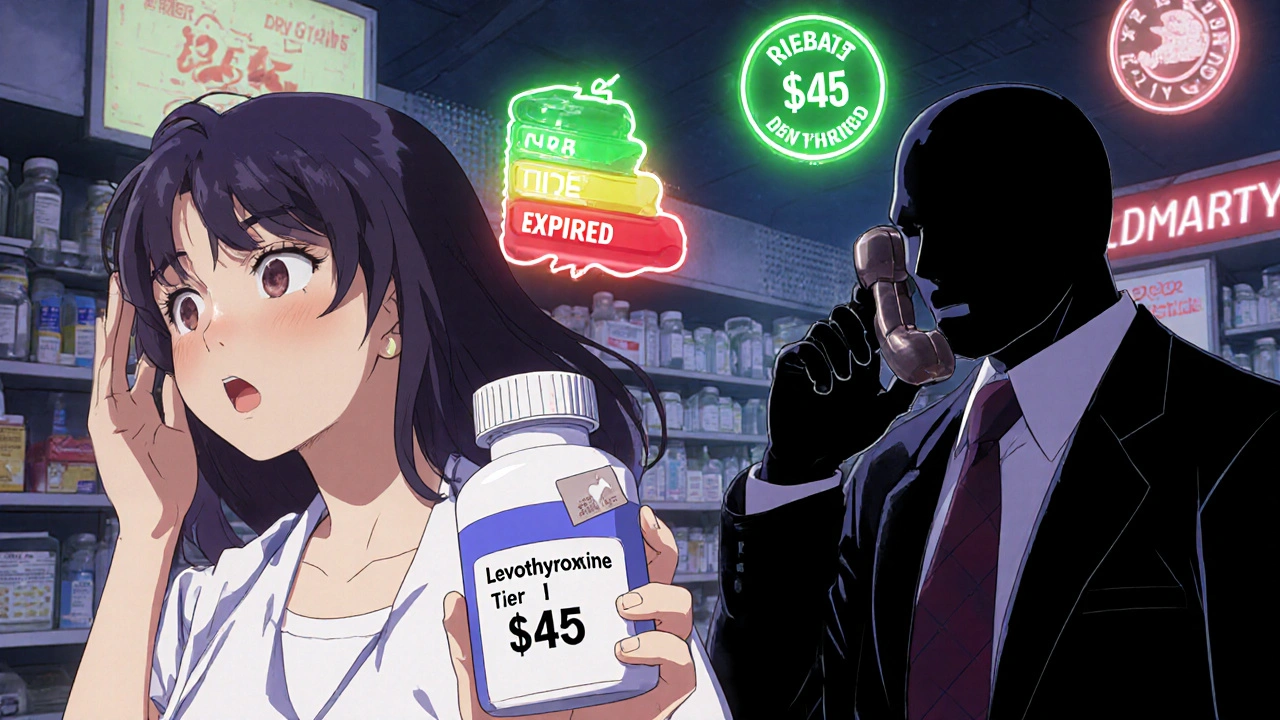

But it’s not just about price. Your plan’s pharmacy benefits manager, the hidden company that negotiates drug prices and sets formularies for insurers decides which drugs go where. That’s why the same medication might cost $10 on one plan and $75 on another. And if your drug gets moved to a higher tier mid-year? You could see your monthly bill jump overnight. Some plans even require prior authorization for Tier 3+ drugs—meaning your doctor must prove you’ve tried cheaper options first.

This system directly affects people managing chronic conditions like diabetes, heart failure, or COPD. For example, a drug like roflumilast, a COPD medication with high out-of-pocket costs, often lands in Tier 4. Meanwhile, metformin, a common diabetes drug that’s widely available as a generic, sits in Tier 1. That’s why switching from a brand to a generic isn’t just about saving money—it’s about staying on your treatment without financial shock.

Knowing your plan’s tiers helps you ask smarter questions. Is there a generic alternative? Can my doctor prescribe a preferred brand? Are there patient assistance programs for drugs stuck in the highest tier? The posts below break down real cases where people fought insurance rules, switched meds to lower costs, or learned why their $5 copay suddenly became $120. You’ll find guides on how to appeal a tier change, how to compare plans during open enrollment, and why some medications—like Fosamax, an osteoporosis drug with multiple alternatives—have better coverage than others. This isn’t just about paperwork. It’s about making sure your health doesn’t get priced out of reach.